When it comes to trading the financial markets, speed and accuracy are critical factors to success. Algorithmic trading, also known as automated trading, uses computer programs and algorithms to execute trades at a speed and efficiency that human traders cannot match. This strategy has become increasingly popular in recent years, and many professional traders and institutional investors rely on algorithmic trading to maximise profits and minimise risks. For algo trading to flourish, sophisticated algo trading software plays a crucial role. They act as the engine behind the algorithms. This blog will discuss the best algo trading software available in the market as of January 2024.

What is Algorithmic Trading?

Algorithmic trading involves using computer programs to execute trades in financial markets. These programs are designed to analyse market data, identify trading opportunities, and execute trades based on predetermined rules and strategies. Algorithmic trading can be used in various markets, including stocks, futures, options, and IPOs.

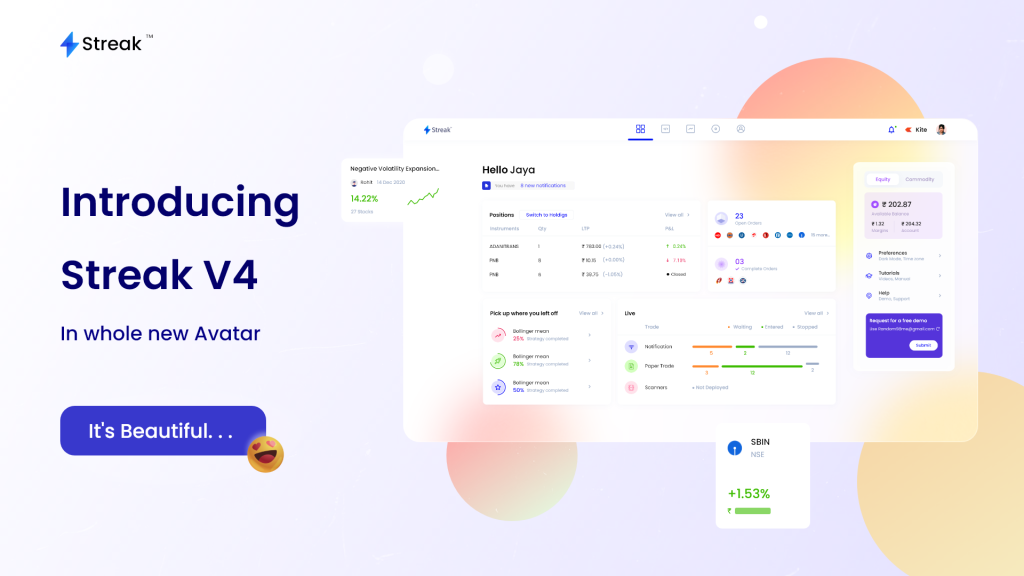

Zerodha Streak

Zerodha Streak is one of the best algo trading software in India. It has a user-friendly interface through which you can execute automated trades without any coding knowledge.

- The benefits of Zerodha streak include:

- Easy to navigate, user-friendly interface

- Nominal brokerage charge of Rs. 20 per transaction

- Access to more than 70 technical indicators

- Real-time market scanners for selecting stocks based on custom conditions

- Backtesting engines for viewing performance metrics of stocks

- Strategy optimisation techniques to create 1 million unique strategies with various combinations

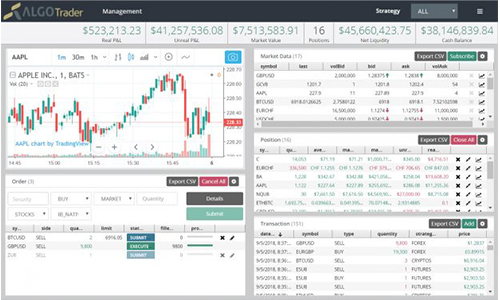

Algo Trader

Algo Trader is one of the oldest algo trading software. It has a presence in several countries around the world, including India. This algo trading platform of a Swiss company was first introduced in 2009 with versions 2.2 and 2.3. Since then, comprehensive editions have been made available in successions to ensure an enhanced trading experience.

The advantages of Algo Trader include:

- A range of charts and indicators for accurate market predictions

- Access to quick asper engine for high-precision trading

- Extensive data processing capabilities enable high-frequency trading

- Comprehensive assistance with online training post-installation

- One of the most affordable algorithmic trading platforms

- Option to trade in cryptocurrencies

- Use of modern technology with 200% back-test acceleration potential

Robo Trader

Robo trader is brand-new algo trading software recently made available to investors in India. It is one of the most popular algo trading platforms owing to its user-friendly interface and the availability of extensive tools.

The top features of Robo Trader include:

- Naked options trading strategy for automated identification and execution of options trading opportunities in underlying stocks

- Scalper propulsion strategy for generating quick profits from short-term price movements

- Allows you to use multiple strategies simultaneously for effective risk management

- Advanced analytics and real-time data analysis tools to help you make informed trading decisions

- Maximise your profits with the help of automated trailing stop-loss

- An option to shift between automated and manual trading

ACE FundTech

ACE FundTech is the algo trading facility offered by one of the most popular stockbrokers in India – Motilal Oswal. It allows you to invest in pre-defined equity portfolios with deep-rooted fundamentals. It helps in automatic investment in companies with the best financials while also considering technical evaluation.

The primary features of ACE FundTech include:

- Diligent stock picking based on financial data and technical analysis

- Allows you to create a well-diversified portfolio through automation

- You can review your portfolio in real-time

- 24 X 7 portfolio tracking facility

- Superior returns as compared to index performance

- You can start with a minimum investment of Rs. 1 lakh

NinjaTrader

NinjaTrader is a comprehensive trading platform designed for active traders, particularly in the futures and forex markets. It has no account minimum requirement to open an online futures brokerage account, allowing you to choose your own starting balance.

- Highly customisable charts with technical indicators.

- Order flow visualisation to identify buying and selling pressure and confirm market movement in a specific direction

- Seamless order routing across markets.

- Create and execute automated strategies.

- Test strategies on historical data for performance analysis.

- Free simulated trading with virtual funds for risk-free testing.

- Third-party add-ons and indicators, allowing traders to extend the platform’s functionality with additional tools and features.

- Get started with an account size of your choice.

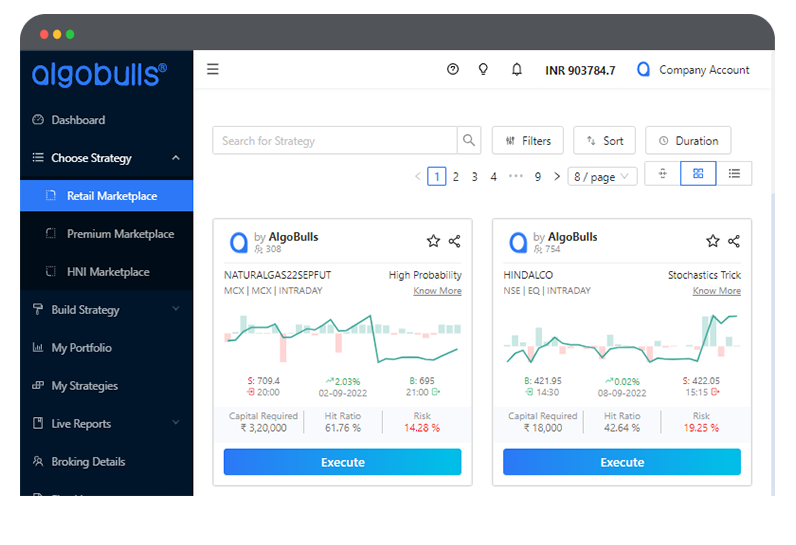

Algobulls

Algobulls is a popular personal AI assistant for crypto trading. You can build automated trading bots powered by artificial intelligence and machine learning. These bots crunch data, analyse charts, and execute trades based on your customised strategies.

- Build personalised bots using AI and machine learning (ML) strategies.

- Test and refine your bots against historical data for optimal performance.

- Practice and refine your strategies without risking real capital.

- Automate trades across various crypto exchanges directly.

- Access advanced charting and indicators for informed decision-making.

- Learn from experienced traders and share strategies.

Conclusion

Choosing the best algo trading software depends on your skill level, budget, and desired features. Whether you are a seasoned pro or a curious beginner, there’s a platform to empower your trading journey. This list can help you in your exploration. Dive deeper, experiment, and find the perfect AI co-pilot to navigate the trading market confidently.